Supportive Measures (1)

Energy Conservation & Recycling Assistance Law

Energy Conservation & Recycling Assistance Law

| AEEC Home | Training Index | Index | Top | Previous | Next |

| METI/ECCJ/AOTS Training Program | Indonesia |

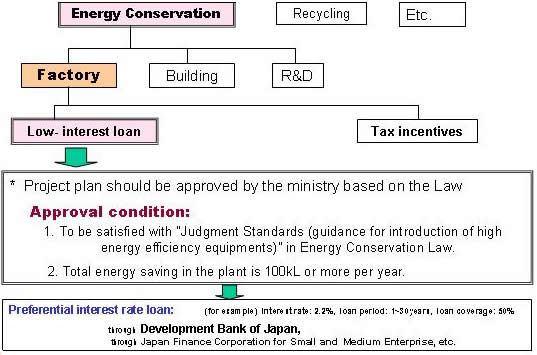

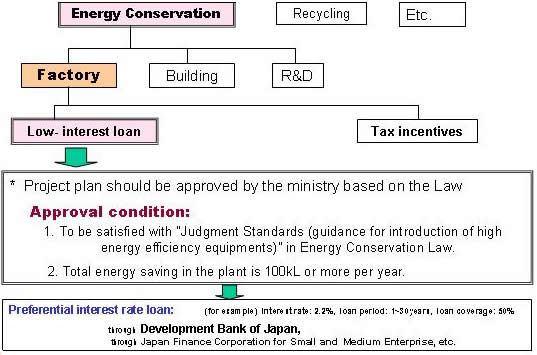

4. Supportive System by Government (for Investment and Technology Development) |

Supportive Measures (1) Energy Conservation & Recycling Assistance Law |

|

Tax Incentives -From 1984- |

|||||||||||||||||||||

* Basic acquisition cost = [Acquisition cost] x [Multiplier rate (25 to 100%)] * Special depreciation: The depreciation is classified as "loss" as defined in the Tax Law, and is included in the calculation of profit in the settlement of accounts. [Status regarding the use of tax incentives] (Unit: cases)

|

Supportive Measures (2) Subsidy Many subsidy schemes are handled by NEDO and other organizations |

|

| 8/23 Next |

| AEEC Home | Training Index | Index | Top | Previous | Next |