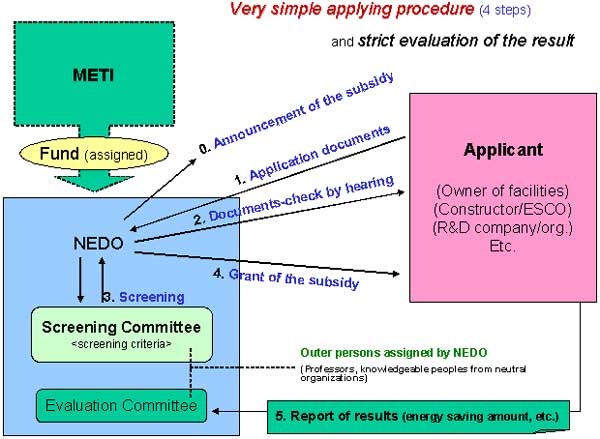

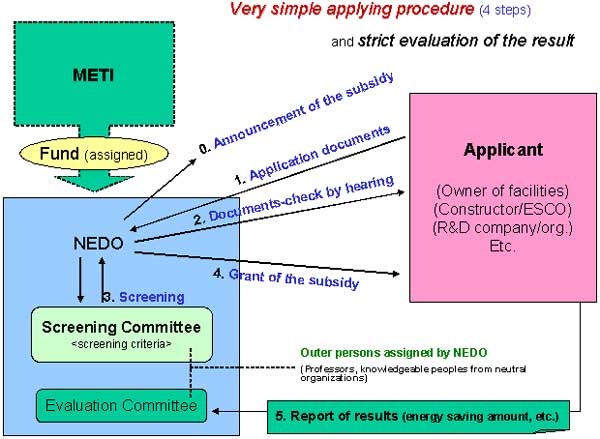

<Example > Applying procedure for the subsidies by METI/NEDO

| AEEC Home | Training Index | Index | Top | Previous | Next |

| ECCJ / AOTS Philippines training course | Philippines |

Advertising activity for Supportive Measures <by the Energy Conservation Law, the E-C and Recycling Assistance Law > |

| Tax incentives: for: 91 facilities designated by METI 52 facilities designated by METI for small and medium enterprises Systems approved on the basis of the “Assistance Law” Tax incentives: income tax exemption equivalent to 7% of the equipment acquisition cost or special depreciation of up to 30% of the equipment acquisition cost Low interest loan: for: Regenerative burner furnace, Inverter system facility, Co-generation system, Retro-fitting of building by ESCO, High energy efficiency building construction, High energy efficiency electric furnace & boiler & hot-water server, etc. through: Development Bank of Japan, Japan Finance Corporation for Small and Medium Enterprise, National Life Finance Corporation, etc. Subsidies: for: project for installation of advanced energy efficiency facilities, introduction of Co- generation system, introduction of HEMS/BEMS, purchasing High energy efficiency hot-water server and low CO2 emission auto mobile and high heat insulation house, ESCO project, R&D project for high energy efficiency technology and system, etc. Through: NEDO and other organizations |

<Example > Applying procedure for the subsidies by METI/NEDO |

|

4. Promotion toward “Smart Life” for Civil, Commercial and Transportation Sectors |

Energy-conservation type new lifestyle, “Smart Life” |

|

| Smart Life is a new lifestyle intended for a clever and smart life without using unnecessary energy while enabling daily life healthful. The initiative of “Smart Life” is designed as a new life style enabling people to act voluntarily in full understanding energy conservation, not because of being forced, nor because of the presence of regulation. |

| 9/16 Next |

| AEEC Home | Training Index | Index | Top | Previous | Next |